Should AI X-Risk Worriers Short the Market?

Tyler Cowen says Effective Altruists aren't acting according to their beliefs.

Tyler Cowen asserts that if you are concerned about existential risk, you should be short the market, and he has a list of 10 bad responses he says EAs give if asked why they aren’t short.

If you pose the “have you thought through being short the market?” question, one hears a variety of answers that are what I call “first-order wrong.” That is, there may well be more sophisticated defenses of those points of view, but you just hear the first-order response, designed to dispose of the question without much further thought. A few of those responses are:

1. “Why should I have to gamble?” (Given your other views, it is hedging not gambling)

2. “There is already evidence I am right. My friends and I made a lot of money buying Nvidia stock.”

3. “I don’t know how to short the market.” Or “Amateur investors shouldn’t short the market!”

4. “Did the stock market predict Hitler and WWII?”

5. “How possibly can I cash in if the world ends very suddenly? After all, the AGI has an incentive to deceive us.”

6. “But I don’t know when the world is going to end!”

7. “Why should I short the market when I can earn so much more going long on Nvidia!?”

8. “Well, I am not buying stocks!”

9. “If the world is ending soon, what do I need money for?”

10. “But if the world doesn’t end, things will be really great.”

And more. (I’ve even heard “Are you short the market?”) I will leave it as an exercise to the reader to work out what is wrong with these responses. In most cases o1 and Claude can come to your aid, if needed.

Some of these sounded pretty reasonable to me, notably 5, 6, and 9, but as Tyler didn’t find it necessary to tell me exactly how I was a moron, I turned to Claude for those:

(5) "Can't cash in if world ends suddenly" The flaw: This assumes binary outcomes (total extinction vs business as usual). One could profit from market drops during early signs of AI problems, before any theoretical point of no return.

(6) "Don't know when world will end" The flaw: Markets offer various instruments with different time horizons. If someone has strong views about AI risk within a particular timeframe, they could choose corresponding investment vehicles.

(9) "What do I need money for if world ends?" The flaw: Again assumes binary outcomes. Money would be valuable in many scenarios short of complete extinction, and could fund efforts to prevent worst outcomes.

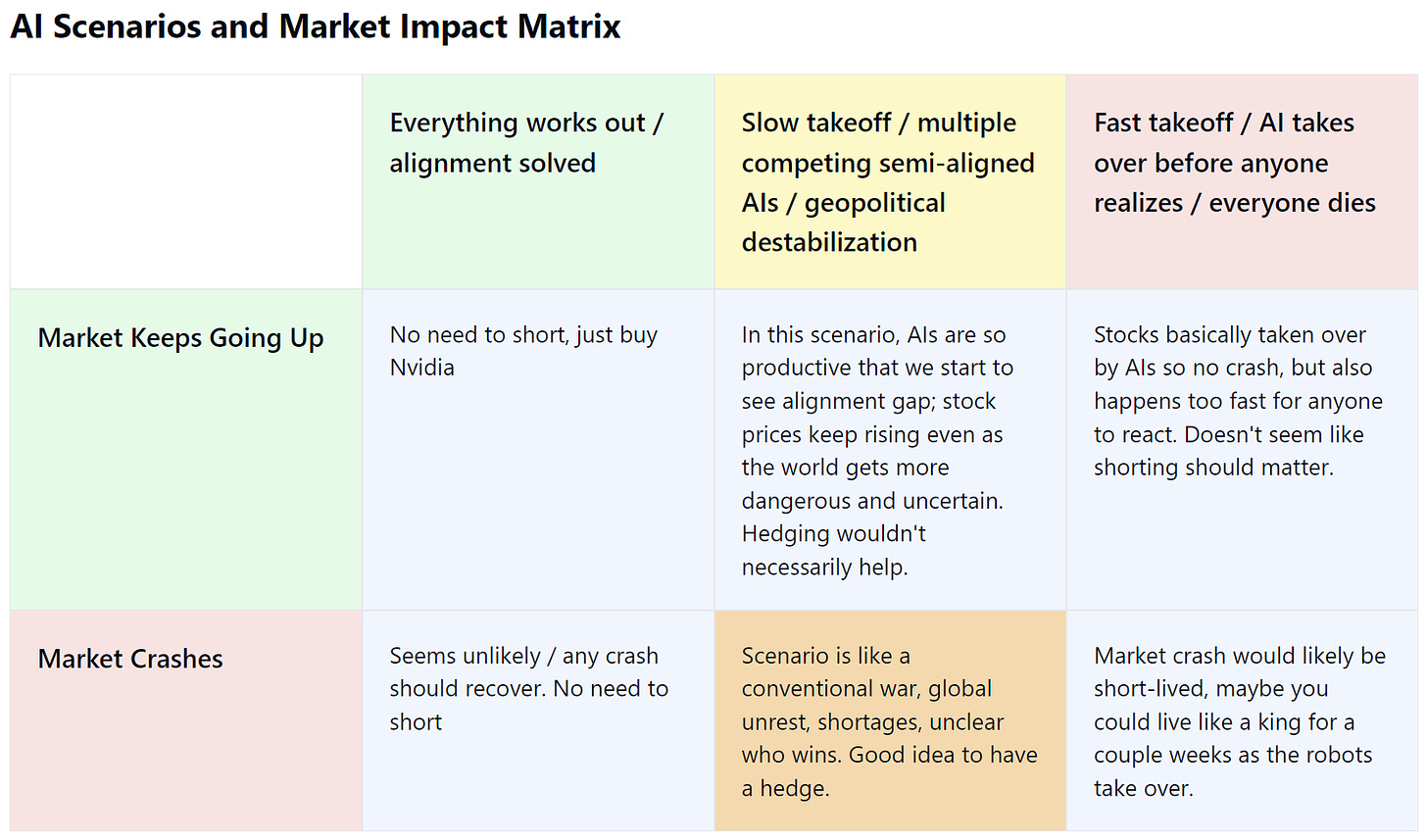

Claude makes a good point that outcomes are not necessarily binary; there’s a wide range of possible AI outcomes besides “my Nvidia stock goes to the moon” and “all humans are dead”. Additionally, there’s a question of whether the market will actually drop in the cases where bad things happen; if AIs have largely taken over the management of companies, it’s possible we will see skyrocketing valuations as AIs trade with each other even as the world gets worse for humans as the AIs battle it out amongst themselves. Thus, I have created this color-coded chart (Claude helped):

You can see here why a lot of EAs might not initially think about hedging. If you’re guessing the two most likely scenarios are in the right or left column, hedging isn’t going to do much.

Since initially encountering fast takeoff scenarios (right-most column) when reading Superintelligence, generative AI has taken off and we’ve seen how real models work. They have training bottlenecks related to physical chips and energy consumption; maybe there are untapped software improvements that will allow future models to scale without any hardware improvements, but no frontier AI companies are acting that way. The takeaway for me is that the future is likely multiple companies or models struggling with limited physical resources even as their abilities and potentially monetary resources grow. This makes the middle scenario more likely.

I think right now I’m skeptical of the slow takeoff / market-keeps-going-up scenario, as multiple agents coming into conflict sounds like it has to be bad for markets, but these futures are very strange already and I’m not confident about anything here. Since the slow takeoff / market crash scenario is the only scenario where we need to hedge though, it seems we should broadly take long positions except for the hedge needed in slow takeoff / market crash.

Does that mean you should short the market? Potentially, or at least there should be some hedging for AI induced geopolitical destabilization. Now that we’ve finally bought Tyler’s premise, how would you actually go about doing that?

Timing

Claude’s critique of (6) sounded reasonable (“Markets offer various instruments with different time horizons”) but I couldn’t really think of a good way to short the market if you had a big range of possible AI timelines. So I asked Claude to elaborate. I gave it parameters of a 10% chance of “really bad outcomes” but I said the timeline was anywhere from 4-20 years from now.

It considered and dismissed a few hedging strategies: long-dated put options, VIX/volatility products, gold/bitcoin, and deep out of the money options.

The core problem is that most hedging instruments are designed for shorter timeframes. Traditional portfolio insurance gets very expensive over a 16-year horizon.

Let me flip this around: What would an ideal hedging instrument look like for your scenario?

Long dated (4-20 years)

Small regular premium

Big payoff in crisis

Not tied to specific timing

Doesn't drag much on portfolio returns

Actually... I realize I'm not seeing anything in traditional markets that really fits these requirements well. This suggests Cowen's call to "learn more finance" might be insufficient - we might need new financial instruments specifically designed for long-term catastrophic risk scenarios.

This is a genuinely hard problem that perhaps explains some of the EA reluctance better than Cowen acknowledges.

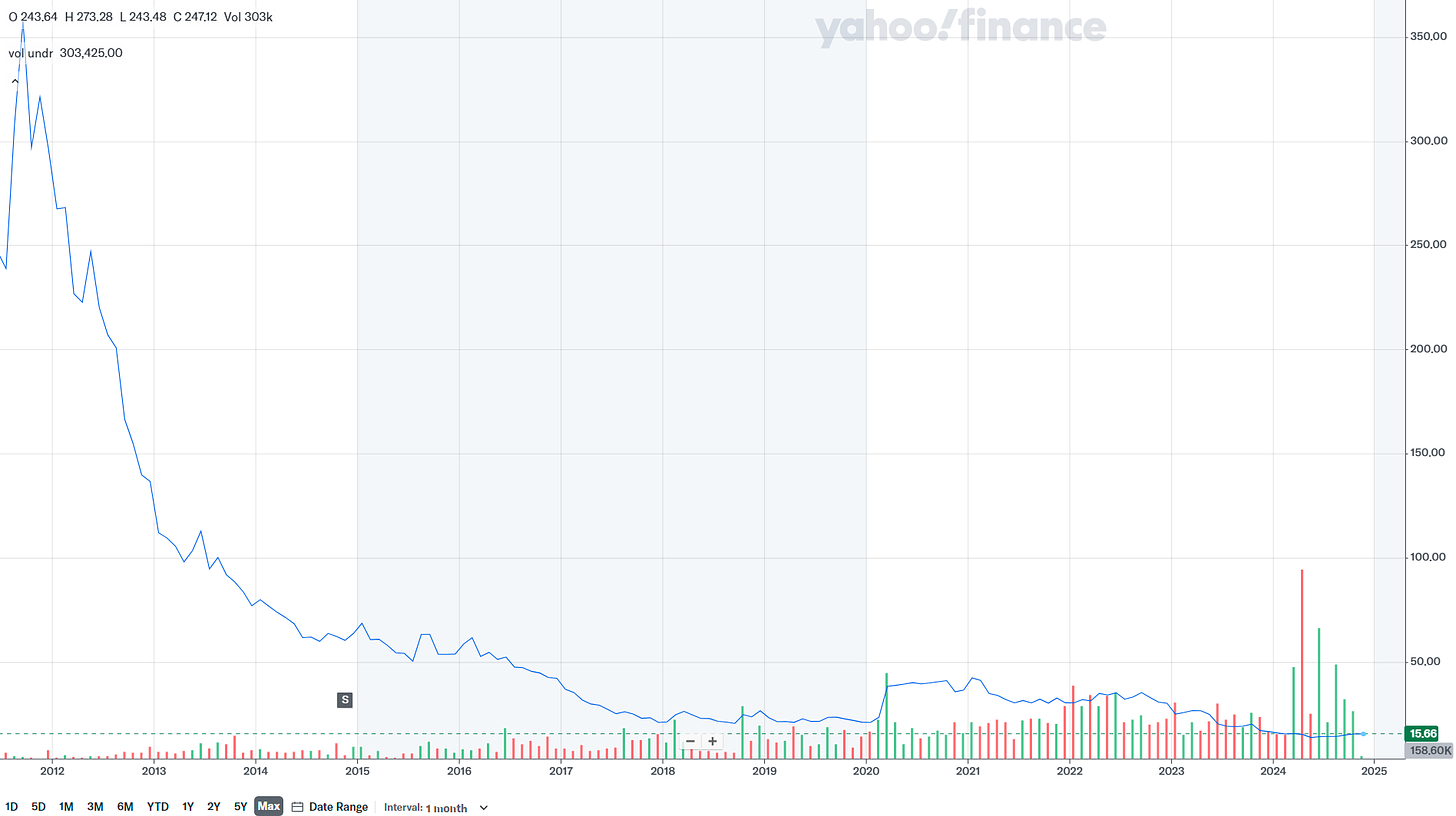

Well there you have it. Claude even specifically mentioned the VIX contango issue with investing long term volatility products. You can read more about it here, but basically it means you are paying a premium to hold VIX futures if the market doesn’t think the VIX is about to spike. You can’t trade on the VIX directly, but instead you can buy VIX Futures ETFs. The contango issue cashes out in these ETFs as a continually dropping valueover time. Even the medium term VIXM dropped 90% of its value in about 5 years.

And had you been holding it during the last big volatility event at the beginning of Covid, you would have only recovered to the 2017 level about 3.5 years prior. In other words, if you think AI volatility is more than 3.5 years away (I’d assign a big chunk of probability to that), anything you put in now will be wiped out, assuming the market crash is similar to Covid. On the other hand, perhaps the crash will be much worse than Covid, and thus the VIX will see a much bigger increase, and perhaps other EAs think we are much closer to a bad-but-not-megadeath event. If so, here’s something to buy.

Strategy Implementation

Of course, how much should you buy? What percent of your portfolio should it be? What is the actual expected value in the situation given timing uncertainty? These are not simple questions.

Even the most straightforward cases of portfolio theory are much more complicated than it might seem. Financial services companies like Vanguard, have put together low expense ratio, diversified, easy to purchase funds that will provide solid diversification and exposure with minimal overhead and cost. They even have target date funds that you can purchase based on your expected retirement and they will automatically rebalance towards more conservative assets as you near the target dates. But if you want to do anything more complicated than that, you have to make some assumptions on your own and it’s not particularly clear which way to go! These include additional diversification, like exposure to real estate, commodities, cryptocurrencies, or anything else. If you want to take into account more lumpy income or concern that your job is as risk, now you have to calculate what percentage of your assets you should keep liquid. How about the decision to add to a Traditional vs Roth IRA? Here’s a cool 10,000 word article on Bogleheads to work through in your spare time.

Given that even relatively common and straightforward retirement portfolios have still unanswered questions, asking EAs why they haven’t devised a formal financial portfolio strategy for tail risk AI scenarios seems a tad unfair, even if technically Tyler was just prodding at the specific takes he listed.

I’m about to get snarky, so let me make sure I concede at least a small point: looking at some sort of insurance product isn’t a ridiculous idea. Given the complexity and expense of holding hedging positions, I’m not sure hedging is worth the portfolio cost, although clearly there’s a wide range of possible probabilities to consider. Moreover, just slightly increasing your consumption now is not an unreasonable response either and is a form of hedging across time.

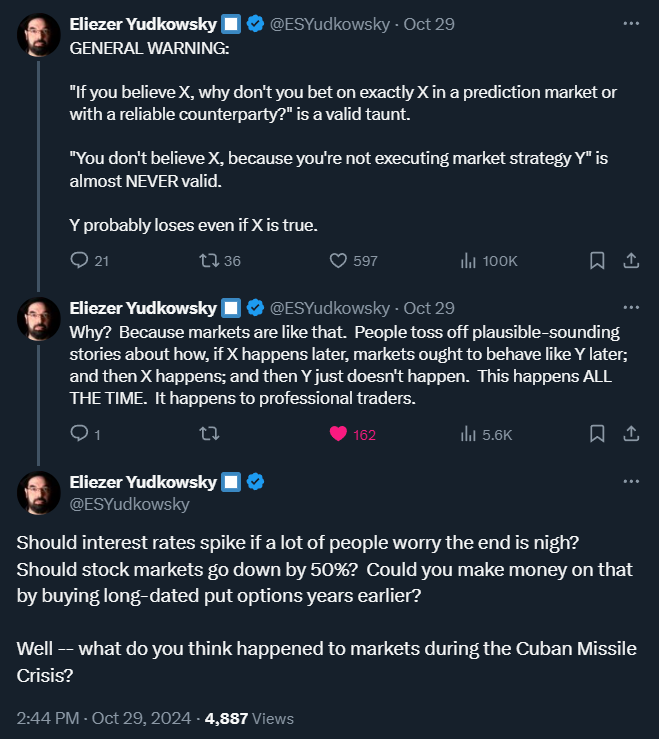

Of course, all this is assuming the need to hedge against a market drop is correct. Eliezer is skeptical:

And actually in Tyler’s original post, while Tyler dismisses point (2) (“There is already evidence I am right. My friends and I made a lot of money buying Nvidia stock”), after taking a quick look at the magnitude of the challenge in front of us, I think EAs deserve some credit here for calling the Nvidia run up. Apparently Tyler himself has never actually achieved any impressive trades based on his views despite haranguing EAs about not doing it:

Perhaps Tyler ought to study finance a bit to get more comfortable with it!